Loading

Get India Form 27q 2003-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the India Form 27Q online

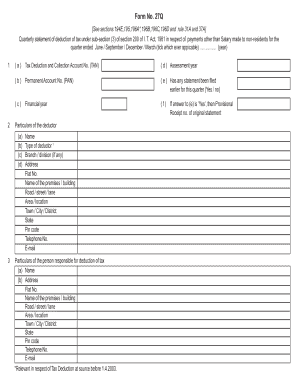

Filling out the India Form 27Q online can seem challenging, but with a detailed guide, the process becomes manageable. This form is essential for reporting tax deductions made under various sections of the Income Tax Act for payments made to non-residents.

Follow the steps to complete the form effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Specify the financial year and assessment year by selecting the appropriate options. Ensure you also tick the box indicating the quarter (June, September, December, or March) for which you are filing the statement.

- Input your Tax Deduction and Collection Account Number (TAN) and Permanent Account Number (PAN) in the designated fields.

- Provide details about the deductor, including name, type of deductor, branch or division, and complete address with pin code and contact information.

- Fill in the verification information, certifying that all furnished particulars are correct and complete.

- Detail the tax deducted and paid to the Central Government, including sections, TDS amounts, surcharges, and education cess. Ensure that all calculations are accurate.

- List the amounts paid and the tax deducted from each deductee. Use an annexure for each line item from the main form, detailing further information about each deductee, including PAN, amounts credited, and relevant sections.

- Finalize the form by verifying all sections have been filled out accurately. After that, you can save the changes, download, print, or share the completed form.

Complete your documents online with confidence and accuracy.

If you do not have a PAN, you may still be able to file your TDS return, but you will need to provide a valid reason for its absence. In this case, filling out the India Form 27Q may require additional steps. It's advisable to consult a tax professional or use resources from uslegalforms to ensure compliance with the regulations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.