Loading

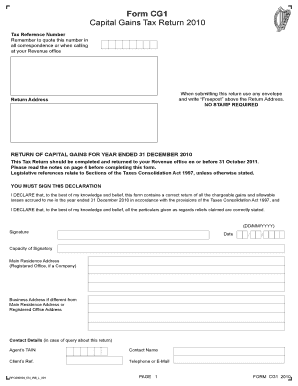

Get Ie Form Cg1 2010

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IE Form CG1 online

Filling out the IE Form CG1 online is essential for individuals reporting capital gains for the tax year. This guide provides clear, step-by-step instructions tailored to help users understand each section of the form with ease.

Follow the steps to complete the IE Form CG1 online effectively.

- Press the ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- Locate the Tax Reference Number field at the top of the form. It is essential to enter your Tax Reference Number accurately, as you will need to quote this number in all correspondence related to your form submission.

- Complete the 'Return Address' section by entering the address where you will submit the completed form.

- Fill out the 'Return of Capital Gains for Year Ended 31 December 2010' section, making sure to note the due date for submission and read any relevant notes provided.

- In the declaration area, ensure to sign and date the form where indicated, confirming the correctness of your entries.

- Proceed to the 'Capital Gains' section. Record details of each asset disposed of during the year, including the description, number of disposals, and total consideration for each type of asset.

- Use the 'Claim to Reliefs' section to indicate any reliefs you are claiming by filling in the appropriate details pertaining to your situation.

- Once all sections are completed, review your entries for accuracy. You can then save your changes, download the completed form, print it, or share it, as needed.

Complete your IE Form CG1 online today to ensure you meet your tax responsibilities with ease.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To claim capital gains on your taxes, start by reporting your sales on the IE Form CG1. This form guides you through detailing each sale, calculates your gains, and assesses the tax you owe. Accuracy is essential, so ensure you have all relevant sale documents handy. A clear presentation of your information can prevent potential issues with tax authorities.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.