Loading

Get Frostburg State University Federal Perkins Loan Disclosure Statement 2017-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Frostburg State University Federal Perkins Loan Disclosure Statement online

Completing the Frostburg State University Federal Perkins Loan Disclosure Statement is essential for understanding your loan details and responsibilities. This guide will walk you through the process of filling out the form online, ensuring that you have all the information you need to proceed confidently.

Follow the steps to successfully complete your disclosure statement.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

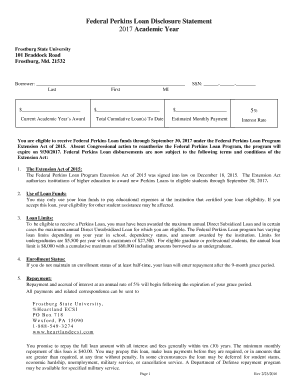

- Begin by filling in your personal information, including your full name: last name, first name, and middle initial.

- Next, enter the current academic year's award amount. This figure reflects the funds you are eligible to receive for the year.

- Provide the total cumulative loan amount you have borrowed to date. This includes all previous Perkins loans.

- Include your Social Security Number by entering it in the designated field.

- Indicate your estimated monthly payment, calculated at an annual interest rate of 5%. Make sure this reflects your understanding of the loan repayment terms.

- Carefully review the terms of the Perkins Loan, including your eligibility timeline and the conditions for loan use.

- Understand the loan limits and enrollment status requirements detailed in the document, ensuring you are aware of the conditions that could affect your repayment.

- Acknowledge the repayment terms and the possible consequences of defaulting on your loan. It is vital to comprehend the responsibilities you are agreeing to.

- Finally, sign and date the document at the bottom to confirm that you have received, reviewed, and understood the disclosure notice.

- Once you have completed all fields, you can save your changes, download the form, print it for your records, or share it as needed.

Complete your Federal Perkins Loan Disclosure Statement online today to ensure you meet your educational financing needs.

Even if you didn't receive a 1098-E from your servicer, you can download your 1098-E from your loan servicer's website. If you are unsure who your loan servicer is, log in to StudentAid.gov or call the Federal Student Aid Information Center at 1-800-4-FED-AID (1-800-433-3243; TTY 1-800-730-8913).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.