Get Il Llc-5.5(s) 2010

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IL LLC-5.5(S) online

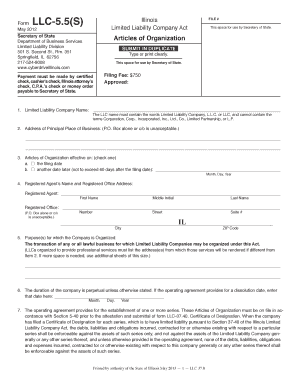

Filling out the IL LLC-5.5(S) form is a crucial step in establishing a limited liability company in Illinois. This guide will provide you with a clear, step-by-step process to complete this form online, ensuring that you can navigate it with ease.

Follow the steps to successfully complete the IL LLC-5.5(S)

- Click the ‘Get Form’ button to access the IL LLC-5.5(S) form and open it in your editor.

- Enter the name of your limited liability company in the designated field. Ensure that the name includes 'Limited Liability Company,' 'L.L.C.,' or 'LLC,' and does not contain any restricted terms such as 'Corporation' or 'Inc.'

- Provide the address of the principal place of business in the appropriate field. Note that a P.O. Box or c/o alone is not acceptable.

- Indicate when the Articles of Organization will become effective by checking the preferred option: either the filing date or a specified future date (up to 60 days later). If choosing a future date, fill in the month, day, and year.

- Enter the registered agent's name and their registered office address. Ensure the address does not include a P.O. Box alone or c/o.

- State the purpose for which the company is organized. If your LLC will provide professional services, include the relevant service address(es) if different from the principal business address.

- If applicable, indicate the duration of the company. Typically, the duration is perpetual, but you may specify a dissolution date if stated in the operating agreement.

- If there are other provisions for regulating the internal affairs of the company, provide them in this section. If more space is needed, use additional sheets.

- Select one option regarding the management of the LLC: either it is managed by managers or has management vested in the members. List the names and addresses as required.

- Complete the name and address of the organizer(s). Ensure that the affirmation is signed with the date. Only original signatures in black ink are acceptable.

- Once all required fields have been filled out and verified, save your changes. You can then download, print, or share the completed form as needed.

Begin filling out your IL LLC-5.5(S) online today to successfully establish your limited liability company.

Get form

The best type of LLC for you typically depends on your business goals and structure. For many, a standard LLC offers flexibility in management and taxation, without needing extensive compliance. Additionally, Illinois LLCs, including the IL LLC-5.5(S), provide personal liability protection while allowing you to benefit from pass-through taxation. Consider your specific needs to make an informed choice.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.