Loading

Get Il I 222 2009-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IL I 222 online

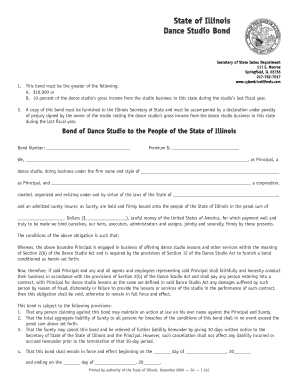

Completing the IL I 222 form online is an essential step for dance studios in Illinois to fulfill their bonding requirements. This guide provides a clear and structured approach to help you navigate each section of the form, ensuring you meet all necessary criteria.

Follow the steps to successfully complete the IL I 222 form.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Fill in the bond number in the designated field at the top of the form.

- Indicate the premium amount that corresponds to the bond for your dance studio.

- Provide the name of the principal (dance studio) and the business name under which you are operating.

- Identify the surety company by entering its name, along with the state where it is organized.

- Specify the penal sum, which must be equal to either $10,000 or 10 percent of your studio's gross income from the last fiscal year.

- Complete the signature fields as required, noting whether the principal is a corporation or an individual.

- Include the date of execution along with the notary public's signature in the appropriate areas.

- Proceed to fill out the declaration section where you will state the gross income from your studio’s business for the last fiscal year.

- Validate your entries and ensure all information is correct before proceeding to finalize your form.

- Finally, save your changes, then download, print, or share the completed form as needed.

Complete your IL I 222 form online today and ensure compliance for your dance studio.

Related links form

To file a will in Illinois, you need to submit it to the probate court in the county where the deceased lived. Ensure that you have proper documentation, including the original signed will and the necessary forms. For a seamless experience and assistance with legal documentation, platforms like USLegalForms can provide the resources needed to navigate this process effectively.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.