Loading

Get Form 15h In Hindi Format No Download Needed

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Form 15h In Hindi Format No Download Needed online

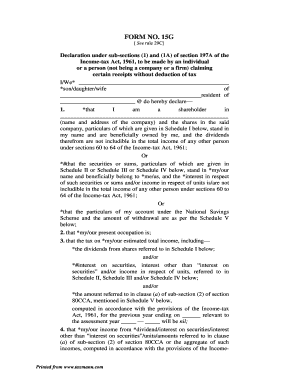

Form 15h is a declaration under the Income-tax Act, allowing individuals to claim certain receipts without tax deductions. This guide provides a step-by-step approach to completing the Form 15h online, ensuring clarity throughout the process.

Follow the steps to complete the Form 15h online effectively.

- Click ‘Get Form’ button to access the Form 15h and open it for editing.

- In the first section, fill in your name and relationship as specified—son/daughter/partner of—followed by the residency details.

- Indicate your estimated income tax for the previous year, ensuring it reflects as nil if applicable.

- Confirm that your aggregate income from relevant sources will not exceed the non-taxable limit.

- Fill in details regarding previous income tax assessments, if any, or state that you have not been assessed.

- Declare your residency status under Section 6 of the Income-tax Act.

- Complete the schedules by providing specific details related to shares, securities, and National Savings Scheme accounts as required.

- Once completed, you can save changes, and choose to download, print, or share the completed form as necessary.

Complete your Form 15h online today for a hassle-free filing experience.

Form 15G and Form 15H are self-declaration forms that an individual submits to the bank requesting not to deduct TDS on interest income as their income is below the basic exemption limit. For this, providing PAN is compulsory. Some banks allow you to submit these forms online through the bank's website.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.