Loading

Get Or 459-260 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the OR 459-260 online

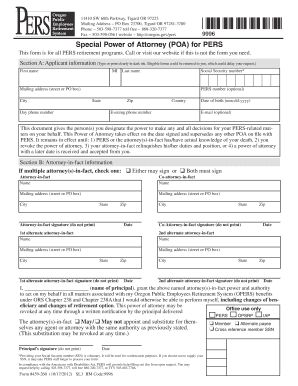

Filling out the OR 459-260 form is an important step in managing your Oregon Public Employees Retirement System (PERS) benefits. This guide will help you understand each section of the form and provide clear instructions for completing it accurately and efficiently.

Follow the steps to successfully complete the OR 459-260 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Complete Section A with your personal information. Write your first name, middle initial, and last name clearly. Provide your Social Security number, mailing address, PERS number, birth date, and contact numbers.

- In Section B, provide information about your attorney-in-fact. If you are designating multiple attorneys-in-fact, select whether either may sign or both must sign.

- Fill out the names and mailing addresses for all attorney(s)-in-fact you are appointing. Ensure that they sign where indicated, along with the date they are signing.

- If applicable, list your 1st and 2nd alternate attorney(s)-in-fact with their names and mailing addresses. Include their signatures and signing dates.

- In the principal’s signature section, sign your name and date the document to validate your Power of Attorney.

- Review the completed form for any errors or legibility issues. Once satisfied, you can save your changes, download a copy, print the form, or share it as necessary.

Complete your OR 459-260 form online today to manage your PERS benefits effectively.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Deciding whether to get an EIN or form an LLC first depends on your business structure. If you plan to create an LLC, it's best to obtain your EIN after forming the LLC. An EIN is crucial for tax purposes and hiring employees, so having it ready will streamline your business processes. For assistance with these steps, consider using OR 459-260 on USLegalForms to easily navigate the requirements.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.