Loading

Get Nc Rec Closing Cost Details

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NC REC Closing Cost Details online

Filling out the NC REC Closing Cost Details form online can seem overwhelming, but with a structured approach, it can be a straightforward process. This guide aims to provide clear, step-by-step instructions to help you accurately complete the form and understand its components.

Follow the steps to complete the NC REC Closing Cost Details form online

- Press the ‘Get Form’ button to access the NC REC Closing Cost Details form and open it in an editor.

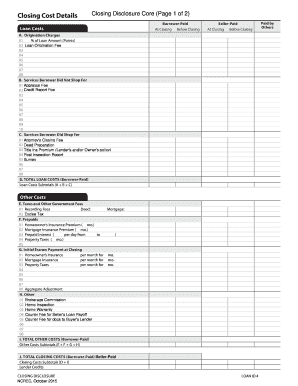

- Begin with the Loan Costs section. Enter the Borrower-Paid costs which include Origination Charges, Services Borrower Did Not Shop For, and Services Borrower Did Shop For. Fill in the percentage of the loan amount for points, loan origination fee, appraisal fee, credit report fee, attorney's closing fee, deed preparation, and any other relevant costs.

- Calculate and enter the total loan costs under the TOTAL LOAN COSTS section, which is the sum of the entry amounts from the previous fields.

- Move on to the Other Costs section. Fill in taxes and government fees, including recording fees for the deed and mortgage, and any excise tax.

- In the Prepaids section, input amounts for homeowner’s insurance, mortgage insurance, prepaid interest, and property taxes.

- Complete the Initial Escrow Payment at Closing section. List monthly amounts for homeowner’s insurance, mortgage insurance, property taxes, and any aggregate adjustments.

- In the Other section, include any additional costs such as brokerage commission, home inspection fee, home warranty, and courier fees.

- Calculate the total of the other costs and input this in the TOTAL OTHER COSTS section.

- Finally, sum the totals from both the loan costs and other costs to enter the TOTAL CLOSING COSTS. Also, note any lender credits if applicable.

- Review all entered information for accuracy and completeness. Save your changes, and you may choose to download, print, or share the completed form.

Ready to complete your documents online? Start filling out the NC REC Closing Cost Details form today!

If you choose to work with an attorney on your home sale, expect to pay anywhere between $600 to $1,000. Sellers aren't required by the state of North Carolina to employ an attorney for home sales. If you're selling your house without a realtor, it may be a good idea to hire a lawyer.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.