Loading

Get Ct K-193a

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CT K-193A online

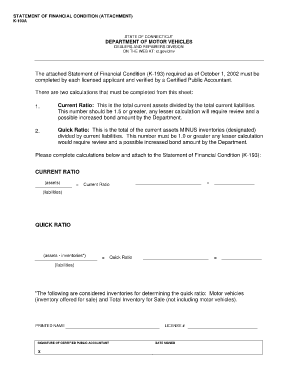

The CT K-193A is a vital form for licensed applicants in Connecticut, used to report the financial condition of a business. Completing this document accurately is essential for compliance with the state's requirements and to facilitate the necessary financial evaluations.

Follow the steps to successfully complete the CT K-193A online.

- Press the ‘Get Form’ button to download the form and open it in your preferred editor.

- Begin by entering the current date on the form to indicate when you are completing it.

- In the section for current assets, list all relevant current assets your business holds. Ensure that these figures are precise to aid in accurate calculation.

- Next, input your total current liabilities in the designated field, as this is crucial for calculating your current ratio.

- Calculate the current ratio by dividing total current assets by total current liabilities. This ratio should be at least 1.5; otherwise, it may prompt further review.

- Proceed to the quick ratio section, where you will state your current assets minus inventories. Make sure to exclude motor vehicles and total inventory for sale from your inventory figures.

- Input the current liabilities again to finalize your quick ratio calculation, which must equal at least 1.0.

- Finally, provide the printed name, signature, license number, and the date signed of the Certified Public Accountant verifying your financial information.

- Once all fields are completed, you can save your changes, download the completed form, or print it for submission. Ensure that all required attachments are included.

Complete your CT K-193A form online today to ensure compliance with Connecticut regulations.

Related links form

Filing sales tax in Connecticut requires you to use the appropriate forms, notably the CT K-193A. Start by collecting data on all sales transactions and the applicable sales tax collected during the period. The user-friendly resources available on US Legal Forms can simplify your filing, helping to ensure that all calculations are accurate and forms are completed correctly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.