Get Ky 211-22 2016-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the KY 211-22 online

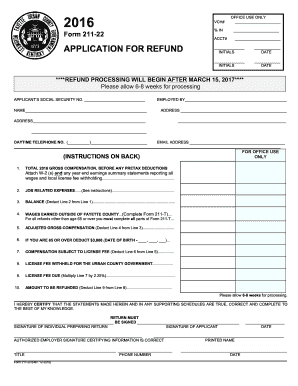

Filling out the KY 211-22 form can seem daunting, but with a clear understanding of its components and sections, you can navigate the process with ease. This guide provides step-by-step instructions tailored to help you complete the application for a refund accurately.

Follow the steps to complete the KY 211-22 application.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your social security number in the designated field. This information is crucial for identification purposes.

- Provide your employer's name, followed by your own name in the respective fields. Ensure that each name is spelled correctly.

- Fill in your address appropriately, making sure to include all relevant details such as street, city, and zip code.

- Enter your daytime telephone number and email address for communication purposes.

- Proceed to line 1 where you will report your total gross compensation for the year. Attach any W-2 forms and year-end earnings summaries securing this information.

- In line 2, list any job-related expenses incurred during the year. Make sure to attach relevant documentation such as Federal Form 2106.

- Calculate the balance by deducting the job-related expenses from your total gross compensation (Line 3).

- If you earned wages outside of Fayette County, fill out the Form 211-T, and report that information in Line 4.

- Derive your adjusted gross compensation by deducting wages earned outside Fayette County from the balance established in Line 3 (Line 5).

- If you are 65 years or older, input your date of birth and apply the $3,000 exemption on Line 6.

- Calculate the compensation subject to the license fee by deducting any exemptions applied in Line 7.

- Report the total license fee withheld in Line 8, and calculate the fee due by multiplying the amount in Line 7 by 2.25% in Line 9.

- The amount to be refunded is determined by subtracting the license fee due from the withheld amount (Line 10).

- Certify the application by signing where indicated. Remember that both the individual preparing the return and the employer must sign the form.

- Finally, save your changes, and if necessary, download, print, or share the completed form as required.

Take the first step toward your refund by completing the KY 211-22 online today.

Your Kentucky state tax return should be mailed to the address provided in the tax return instructions specific to your form. Generally, this information can be found on the Kentucky Department of Revenue's website. Keep in mind, if you use KY 211-22 as a reference, you can ensure that you're following the correct procedures for your state tax obligations. Double-checking the address before sending can help prevent delays.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.