Get Partial Exemption Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Partial Exemption Form online

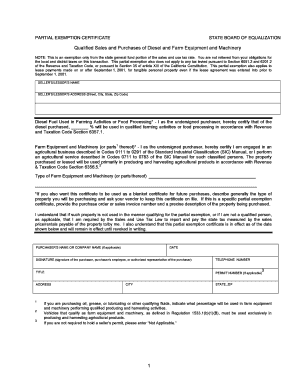

Filling out the Partial Exemption Form online is an important process for individuals and businesses wishing to take advantage of sales tax exemptions on diesel and agricultural equipment. This guide will provide you with step-by-step instructions to help you complete the form efficiently and accurately.

Follow the steps to complete the Partial Exemption Form online:

- Press the ‘Get Form’ button to access the Partial Exemption Form and open it in your web browser.

- Begin by entering the seller’s or lessor’s name in the designated field. Ensure that the name matches that of the vendor you are purchasing from.

- Next, fill in the seller’s or lessor’s address, including the street, city, state, and zip code. This information is necessary to identify the seller accurately.

- Indicate the percentage of diesel fuel that will be used in qualified farming activities or food processing. Write the percentage in the provided space.

- Confirm that you are engaged in an agricultural business by stating the relevant codes from the Standard Industrial Classification Manual. If applicable, describe the type of farm equipment or machinery being purchased including any relevant details.

- If you want to use this certificate as a blanket certificate for future purchases, mention the general type of property you will be acquiring. Otherwise, provide your purchase order or sales invoice number.

- Read the certification statement carefully. By signing the form, you acknowledge your obligations under the Sales and Use Tax Law.

- Enter your name or the name of your company, along with the date of completion. Make sure to sign the document either by hand or electronically.

- Finally, fill in the telephone number and title of the individual completing the form. If applicable, include your permit number and address, along with the city, state, and zip.

- Once you have filled out all sections accurately, you can save your changes, download, print, or share the form as required.

Begin completing your Partial Exemption Form online today!

Related links form

California's partial exemption rate varies based on the goods or services being purchased and the specific circumstances surrounding the transaction. Typically, certain manufacturing, research and development, and agricultural purchases may qualify for reduced rates. Understanding these nuances can lead to substantial savings, so it's crucial to correctly fill out the Partial Exemption Form when applying. For tailored assistance, consider exploring resources on platforms like uslegalforms to guide you through the process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.