Loading

Get Nv El315 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NV EL315 online

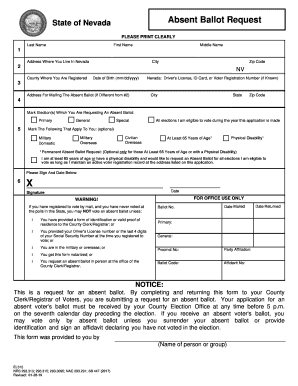

The NV EL315 form is essential for individuals in Nevada seeking to request an absent ballot for elections. This guide provides clear, step-by-step instructions to assist users in completing the form accurately and efficiently.

Follow the steps to successfully complete the NV EL315 form online.

- Click the ‘Get Form’ button to obtain the NV EL315 form. This will open the form in an online editor where you can proceed to fill it out.

- In the first section, clearly print your last name, first name, and middle name.

- Next, provide your address where you live in Nevada, including the city and zip code.

- Indicate the county where you are registered to vote and enter your date of birth in the format mm/dd/yyyy. If known, include your Nevada driver's license, ID card, or voter registration number.

- If you have a different mailing address for the absent ballot, enter that address in the subsequent section. Include the city, state, and zip code.

- Mark the elections for which you are requesting an absent ballot. Options include primary, general, special, or all elections you are eligible to vote in during the year of this application.

- Indicate any optional categories that apply to you, such as being part of the military or overseas, having a physical disability, or being at least 65 years of age.

- If applicable, sign and date the form to complete your application for an absent ballot.

- After filling out all the required fields, review the form for accuracy. You can save changes, download, print, or share the form as necessary.

Complete your NV EL315 application online to ensure your voice is heard in upcoming elections.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

You should file the Nevada modified business tax return through the Nevada Department of Taxation's online portal or mail it to their office. Be prepared to include all relevant payroll information, as it determines your tax amount. Timely filing is essential to avoid penalties and interest. For assistance in the filing process, the NV EL315 can serve as a useful tool.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.