Loading

Get Hk Ir56e 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the HK IR56E online

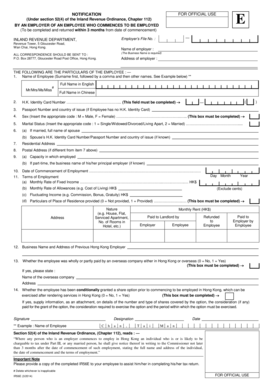

The HK IR56E form is an important document required by the Inland Revenue Department for reporting employment details of new employees. This guide provides a step-by-step approach to filling out the form online, ensuring clarity and accessibility for all users.

Follow the steps to complete the HK IR56E form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Complete the employer’s section by entering the employer's file number, name, and address. Ensure all correspondence is directed to the specified post office address.

- Provide the employee's information, beginning with their full name in English and Chinese, followed by their H.K. identity card number, which is mandatory.

- Fill in the employee's passport number and country of issue if they do not possess an H.K. identity card.

- Indicate the employee's gender using the codes: M for Male and F for Female, ensuring completion of this field.

- Document the marital status of the employee with the corresponding code: 1 for Single/Widowed/Divorced/Living Apart and 2 for Married.

- If the employee is married, provide the spouse's full name.

- Enter the residential address of the employee, and if applicable, fill in the postal address if it differs from the residential address.

- Detail the capacity in which the employee is employed. If part-time, indicate the business name of their principal employer, if known.

- Document the start date of the employee's employment.

- For terms of employment, include the monthly rate of fixed income, monthly allowances, and any fluctuating income such as commissions or bonuses.

- Specify whether the residential particulars have been provided, the nature of the accommodation, and the monthly rent arrangements.

- Provide information regarding the employee's previous Hong Kong employer.

- Indicate if the employee was paid by an overseas company and provide the necessary details if applicable.

- Lastly, indicate if the employee has been granted a share option before commencing employment, and attach detailed information if so.

- Review all entries for accuracy and completeness before submitting the form.

- After completing the form, users can save changes, download, print, or share the document as required.

Complete the HK IR56E form online today to ensure compliance with employment reporting requirements.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The IR56E form is specifically designed for reporting the income of non-resident employees in Hong Kong. This form enables the Inland Revenue Department to assess the tax obligations of foreign workers accurately. Properly completing the HK IR56E ensures compliance and minimizes the risk of tax complications for both employees and employers.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.