Loading

Get Canada T2125 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada T2125 online

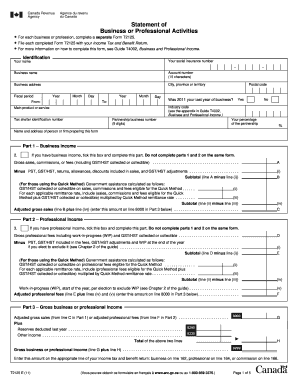

The Canada T2125 form is essential for individuals reporting business or professional activities and income on their tax returns. This guide provides clear, step-by-step instructions to help users complete the form accurately and efficiently, ensuring a smooth online filing process.

Follow the steps to accurately complete your Canada T2125 form online.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by filling in your identification details, including your name, social insurance number, business name, and address. Ensure the fiscal period details, including the start and end dates, are correctly entered.

- Indicate whether 2011 was your last year of business by ticking the appropriate box. Next, input the industry code as referenced in the appendix of Guide T4002.

- If you are reporting business income, tick the box and proceed to Part 1. Enter your gross sales, commissions, or fees, and deduct any PST or GST/HST adjustments to find the subtotal.

- For those with professional income, tick the respective box and complete Part 2. Report gross professional fees and subtract any GST/HST adjustments to calculate the adjusted professional fees.

- In Part 3, combine the adjusted gross sales or professional fees with any reserves from last year and other income to determine your total gross business or professional income.

- Complete Part 4 regarding the cost of goods sold if applicable. Provide details on inventory, purchases, and other costs to calculate gross profit.

- Continue to Part 5 to report net income or loss before adjustments, detailing all business expenses incurred during the year.

- In Part 6, summarize your net income or loss after adjustments, including any applicable deductions.

- After finalizing all sections, save your changes, download the completed form, and prepare to submit it as part of your Income Tax and Benefit Return.

Start completing your Canada T2125 form online today for a seamless tax filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Yes, side hustles are legal in Canada, but they must be reported as part of your income. Engaging in various income-generating activities can be a smart financial strategy, provided you comply with tax laws. Ensure that you use the Canada T2125 form to report any earnings accurately. Staying informed about regulations will help you run your side hustle successfully.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.