Loading

Get Ontario Cpa 4-2fb 2016-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ontario CPA 4-2FB online

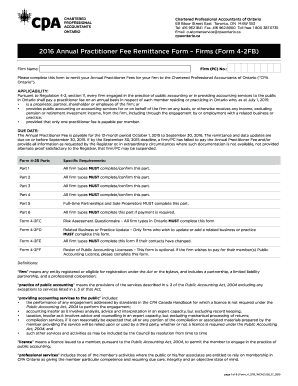

Filling out the Ontario CPA 4-2FB is an essential task for firms engaged in public accounting in Ontario. This guide provides a detailed, step-by-step approach to ensure that users can complete the form efficiently and accurately.

Follow the steps to accurately complete the Ontario CPA 4-2FB online.

- Click 'Get Form' button to obtain the form and open it in your preferred online format.

- Enter your Firm (PC) No. in the designated field to identify your firm's registration.

- Provide the official Firm Name, making sure it adheres to CPA Ontario's name regulation guidelines, including the proper use of 'Chartered Professional Accountant(s)' or 'CPA.'

- Complete the Firm Address section by filling out all required fields, including street address, city, province, telephone, fax, and postal code.

- Indicate the types of services provided by selecting the appropriate option: either 'Engages in the practice of public accounting in Ontario' or 'Providing accounting services to the public in Ontario.'

- In the Updates to Operating Status section, specify the firm type (full-time or part-time) and indicate if there are changes in operating status, including whether the firm is open to the public.

- Review and confirm any updates to the Firm Roster, ensuring that all members listed on the roster are accurate and updated as necessary.

- In the Payment Information section, indicate the total due amount by calculating based on the number of members and ensure that all necessary fees are included.

- Select your payment option, ensuring to provide any required credit card or cheque details, as well as the signature of the cardholder where applicable.

- After filling out all sections, review your form for accuracy and completeness before finalizing your submission. Save, download or print as necessary.

Begin filling out your Ontario CPA 4-2FB online today to complete your firm’s annual fee remittance efficiently.

Related links form

To send your transcripts for the CPA exam, contact your educational institution to request they send the documents directly to the CPA exam office. Make sure you include all necessary details such as your name and registration number to avoid any delays. This step is crucial in your journey toward the Ontario CPA 4-2FB certification.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.