Loading

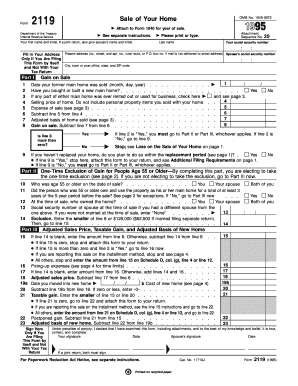

Get Form 2119 Tax Year 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 2119 Tax Year 2012 online

This guide provides a comprehensive approach to completing Form 2119 for the Tax Year 2012 online. It is designed to assist users in accurately filling out each section of the form, ensuring compliance and efficiency.

Follow the steps to complete the form with ease.

- Click ‘Get Form’ button to obtain the form and open it in the preferred editor.

- Begin filling out your personal information. Start with your first name and initial, and if applicable, your spouse's name and initial. Then, enter your last name and social security number. Make sure to provide your current address, including city, state, and ZIP code.

- In Part I, indicate the date your former main home was sold. Answer whether you have bought or built a new main home by selecting 'Yes' or 'No'. If you rented out or used any part of your home for business, check the appropriate box.

- Complete fields for the selling price of the home, excluding personal property items sold with it. Fill in the expense of sale and perform the calculation to determine the gain on sale by subtracting the expense from the selling price.

- Evaluate the gain calculated. If the gain is more than zero, continue filling out the necessary components of Part II or Part III, depending on your responses.

- In Part II, if you are opting for a one-time exclusion of gain, indicate who was age 55 or older at the time of the sale. Confirm if that person owned and used the property as their main home for at least three out of the five years before the sale.

- For Part III, calculate the taxable gain and adjusted basis of the new home. Follow the directional cues and perform needed calculations as outlined in the form.

- Sign and date the form. If you are filing this form by itself and not with your tax return, remember that both you and your spouse must sign.

- After completing all sections, you can save changes, download, print, or share the form as needed.

Complete your Form 2119 and ensure your filing is accurate and timely.

Form 2119 serves to report the sale of your principal residence, particularly concerning tax calculations. In the context of the Tax Year 2012, it provides specific guidelines for homeowners looking to manage their tax obligations effectively. Understanding this form can help you navigate potential tax benefits or consequences related to your home sale.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.