Get Canada Vesp Withdrawal Request Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada VESP Withdrawal Request Form online

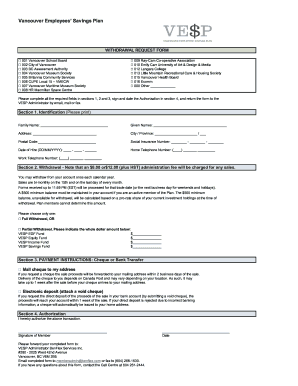

Filling out the Canada VESP Withdrawal Request Form is a straightforward process that ensures you can manage your savings efficiently. This guide will walk you through each section of the form, providing clear and detailed instructions to assist you in completing it online.

Follow the steps to fill out the form correctly.

- Click ‘Get Form’ button to obtain the form and open it in your editor.

- In Section 1, Identification, provide your family name, given names, address, city or province, postal code, social insurance number, date of hire, home telephone number, and work telephone number. Ensure all information is accurate and clearly printed.

- Proceed to Section 2, Withdrawal. Choose either Full Withdrawal or Partial Withdrawal. If opting for Partial Withdrawal, specify the whole dollar amount you wish to withdraw from each fund (VESP EGF Fund, VESP Equity Fund, VESP Income Fund, VESP Savings Fund). Remember that you must maintain a minimum balance of $500 if you are an active member.

- In Section 3, Payment Instructions, select your preferred method of receiving the funds: Cheque or Bank Transfer. If you choose Cheque, understand that it will be mailed to your address. If you opt for Electronic Deposit, attach a void cheque to ensure accurate bank information for the direct deposit.

- Finally, complete Section 4, Authorization, by signing and dating the form. Review all sections to make sure you have filled in all required fields.

- After completing the form, ensure you save your changes. You can then download the form, print it, or share it as needed, and forward it to the VESP Administrator.

Take control of your savings today by completing your withdrawal request form online.

If your RESP is not used in Canada, the funds may be subject to different rules and potential penalties. Generally, unused funds may be withdrawn, but taxes could apply, affecting your overall savings. To navigate this process correctly, you should fill out the Canada VESP Withdrawal Request Form. It's advisable to consult with a financial expert to discuss your options and avoid unintended consequences.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.