Loading

Get Au Nat 3346 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AU NAT 3346 online

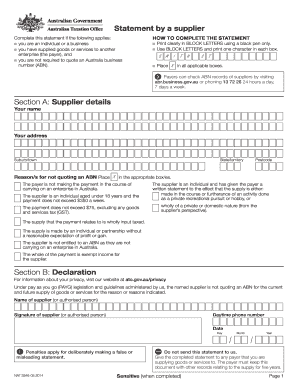

The AU NAT 3346 is a statement that suppliers use to report their goods or services to payers when they are not required to quote an Australian business number (ABN). This guide provides a clear, step-by-step process to help you complete the form accurately.

Follow the steps to effectively complete the AU NAT 3346 form.

- Click ‘Get Form’ button to obtain the form and open it in your preferred text editor.

- Fill in your supplier details in Section A. Clearly write your name, address, suburb or town, state or territory, and postcode using block letters with a black pen.

- Indicate your reason for not quoting an ABN by placing an 'X' in the applicable box or boxes. Make sure to read each option carefully to choose the correct reason.

- Proceed to Section B: Declaration. Here, provide the name of the supplier or authorized person and ensure they sign the statement.

- Enter the daytime phone number of the supplier or authorized person, followed by the date, making sure to include the day, month, and year.

- Review the completed form for accuracy. Ensure all sections are filled properly and all required information is provided.

- Once completed, save your changes. You can download, print, or share the statement as needed, but do not send it to the authorities. Instead, give it to the payer you are supplying goods or services to.

Complete your AU NAT 3346 and manage your documents online securely.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

While a supplier statement provides an overall summary of the financial relationship, an invoice is a specific request for payment of services rendered or goods supplied. The statement aggregates multiple transactions, while the invoice focuses on individual payments. Being aware of these differences will enhance your financial tracking and reporting, particularly when navigating the regulations of AU NAT 3346.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.