Loading

Get Health Savings Account (hsa) Documentation

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Health Savings Account (HSA) Documentation online

This guide provides comprehensive step-by-step instructions to assist users in completing the Health Savings Account (HSA) Documentation online. Following these steps will ensure that your application is completed accurately and efficiently.

Follow the steps to successfully complete your HSA documentation.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Fill in the personal information section, including your Social Security number, date of birth, and contact information. Ensure all starred fields (*) are completed.

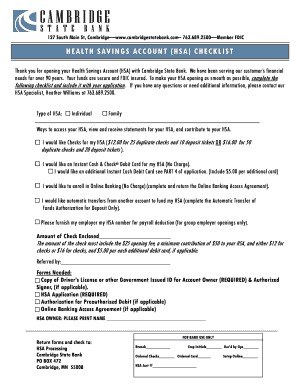

- Select the type of HSA you are applying for: Individual or Family.

- In the High-Deductible Health Plan (HDHP) section, indicate who is covered and whether you are enrolling through your employer.

- Complete the backup withholding certifications, checking the appropriate boxes and initialing as necessary.

- If applicable, designate an authorized signer by filling out the necessary details and checking to order an additional debit card.

- Optional: Fill in the beneficiary information for your HSA.

- Carefully read the required signatures section, confirming your understanding of the terms before signing and dating the application.

- Review your completed form for any missing information, ensuring all necessary documents are included before submission.

- Save your changes, and then proceed to download, print, or share the form as needed to submit your application.

Start filling out your HSA documentation online today for a smooth and secure application process.

Related links form

Health Savings Account (HSA) reporting occurs through your annual tax return using IRS Form 8889. This form tracks your contributions, distributions, and any gains or losses related to your HSA. Staying informed about filing requirements will help you comply effectively with tax regulations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.