Get Form It-205-a:2007: Fiduciary Allocation: It205a - Department Of ... - Tax Ny

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form IT-205-A:2007: Fiduciary Allocation: IT205A - Department Of ... - Tax Ny online

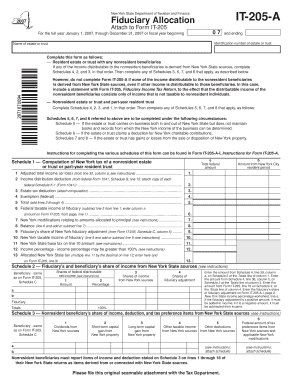

This guide provides clear instructions on how to accurately complete the Form IT-205-A:2007 for fiduciary allocation in New York. By following these steps, you can ensure that your form is filled out correctly and submitted promptly.

Follow the steps to complete the Form IT-205-A online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Identify the type of entity you are filing for: if you are dealing with a resident estate or trust with nonresident beneficiaries, ensure to complete Schedules 4, 2, and 3 in that order. If none of the income to nonresident beneficiaries is from New York sources, include a statement with Form IT-205.

- If you are filing for a nonresident estate or trust or part-year resident trust, complete Schedules 4, 2, 3, and 1 in that order, addressing any applicable Schedules 5, 6, 7, and 8 as outlined.

- Proceed to fill Schedule 1, which includes details such as adjusted total income, income distribution deductions, estate tax deductions, exemptions, and calculations necessary to arrive at New York taxable income.

- Complete Schedule 2 to report fiduciary and beneficiary shares of income from New York State sources, ensuring to indicate correct shares based on the previous computations.

- Fill Schedule 3 to summarize the nonresident beneficiary’s share of income, including deduction and tax preference items from New York State sources.

- On Schedule 4, provide a detailed account of federal distributable net income and amounts from New York State sources, ensuring to track any necessary states and percentage allocations.

- Complete any applicable entries on Schedules 5, 6, 7, or 8, based on your specific tax situation, ensuring you report any business income that may affect allocations.

- Review all entries for accuracy, ensuring proper documentation is attached when necessary, such as copies of federal forms.

- Finalize by saving your changes, and then decide to download, print, or share the form as needed for submission.

Start completing your documents online to meet your tax obligations efficiently.

Form IT-370-PF does not extend the time for filing New York State income tax returns of partners of a partnership or the beneficiaries of an estate or trust. To apply for an extension of time to file those returns, use Form IT-370, Application for Automatic Six-Month Extension of Time to File for Individuals. Instructions for Form IT-370-PF - Tax.ny.gov ny.gov https://.tax.ny.gov › forms › current-forms ny.gov https://.tax.ny.gov › forms › current-forms

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.