Loading

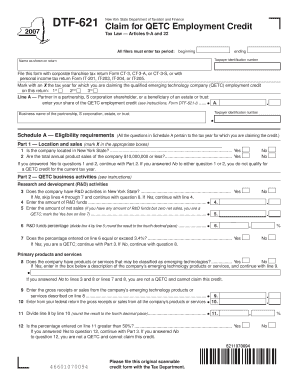

Get Schedule B Computation Of Credit For The Current Tax Year (see Instructions) - Tax Ny

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Schedule B Computation Of Credit For The Current Tax Year (see Instructions) - Tax Ny online

Filling out the Schedule B Computation Of Credit For The Current Tax Year form is essential for individuals and businesses looking to claim the qualified emerging technology company (QETC) employment credit. This guide provides clear, step-by-step instructions to help users complete the form accurately and efficiently.

Follow the steps to complete your Schedule B form successfully.

- To begin, click the ‘Get Form’ button to access the Schedule B form and open it in your document editor.

- Enter the tax period at the top of the form, specifying the beginning and ending dates for the tax year you are claiming. This information is crucial for the calculations.

- Provide your taxpayer identification number along with your name as it appears on your tax return. This ensures that the form is properly attributed to you.

- Mark with an 'X' the tax year for which you are claiming the QETC employment credit. Options are 1st, 2nd, or 3rd tax year as applicable.

- If you are a partner in a partnership, S corporation shareholder, or a beneficiary of an estate or trust, enter your share of the QETC employment credit on line A. Ensure other relevant entity information is filled.

- Proceed to Schedule A to confirm eligibility, answering all questions regarding your business location, annual sales, and research and development activities. If you answer 'No' to key questions, you may not qualify for the credit.

- In Schedule B, start with line 16. Enter the average number of full-time employees from line 13 of the previous section on line 16.

- On line 17, input the average number of full-time employees for the three-year base period as indicated on line 14.

- Perform the calculation for line 18 by subtracting the amount on line 17 from line 16. This will give you the difference in the number of employees.

- Enter the credit amount per employee on line 19. This figure is typically provided in the form instructions or calculated based on the guidelines.

- Calculate the total credit for the current tax year on line 20 by multiplying the result from line 18 by the amount on line 19.

- Finally, list each employee used to compute your average number of full-time employees on the designated lines in the Additional Information section.

- Once all fields are completed, ensure to save your changes. You may also download, print, or share the form as needed.

Complete your Schedule B Computation Of Credit For The Current Tax Year form online to ensure you claim your eligible credits accurately.

The real property tax credit is a refundable tax credit to help low-income households and senior citizens on fixed incomes who are confronted with high property taxes or rents. Those who qualify for the credit can receive a check from the state.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.