Loading

Get 502h

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 502H online

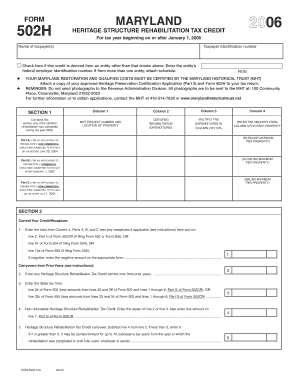

The 502H form is essential for taxpayers seeking tax credits for the rehabilitation of certified heritage structures. Filling it out accurately is crucial to ensure you receive the appropriate credits for your rehabilitation efforts.

Follow the steps to complete the 502H form effectively

- Press the ‘Get Form’ button to access the 502H document and open it in your editing platform.

- Begin by entering the name of the taxpayer(s) and the taxpayer identification number in the designated fields at the top of the form.

- If the credit is derived from another entity, check the box provided and input the entity’s federal employer identification number. Attach a schedule if there are multiple entities.

- For Section 1, complete the required fields for certified rehabilitation expenditures, ensuring to include the MHT project number and property location, as well as the certified rehabilitation expenditures incurred.

- Multiply the expenditures by 20% and enter the results in the corresponding column, applying the maximum limits as specified.

- In Section 2, enter the total credit calculated, ensuring to account for any recaptures as needed, and follow the instructions for the appropriate forms related to your filing.

- Review all entries for accuracy before saving your changes. You will have options to download, print, or share the completed form.

Complete your 502H form online now to secure your tax benefits.

Filling out an expenditure form requires a clear breakdown of your spending. List all expenses accurately, categorizing them appropriately. Ensure you provide necessary details like dates and amounts. Utilizing the 502H form can simplify this process, helping ensure everything is in place.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.