Loading

Get 2022 Ny Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2022 Ny Form online

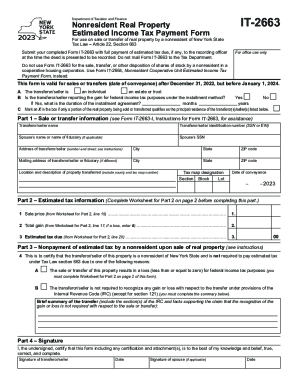

The 2022 Ny Form, known as Form IT-2663, is essential for reporting the estimated income tax due upon the sale or transfer of real property by nonresidents of New York State. This guide will provide you with step-by-step instructions on completing the form online, ensuring that you understand each section and its requirements.

Follow the steps to successfully complete the 2022 Ny Form online

- Press the ‘Get Form’ button to obtain the form and open it in your preferred online document editor.

- Identify the transferor/seller by checking the appropriate box: individual, estate, or trust. Complete the name and identification number (SSN or EIN) fields.

- Provide the spouse's name and SSN if applicable, along with the address of the transferor/seller. Make sure to include the city, state, and ZIP code.

- Enter the location and description of the property being transferred, including the county and tax map number, as well as the date of conveyance.

- Complete Part 2 by using the Worksheet for Part 2 to calculate the sale price, total gain, and estimated tax due. Transfer these numbers to the corresponding fields in Part 2.

- In Part 3, certify whether the transferor/seller is not required to pay estimated tax by checking the relevant box and providing a brief summary if applicable.

- Sign and date the form where indicated, making sure to include signatures from both the transferor/seller and the spouse if applicable.

- Once all fields are completed and reviewed, you can save the changes, download, print, or share the form to submit it as required.

Complete your documents online today to ensure timely and accurate submissions.

Form 1040. The IRS 1040 form is one of the official documents that U.S. taxpayers use to file their annual income tax return. The 1040 form is divided into sections where you report your income and deductions to determine the amount of tax you owe or the refund you can expect to receive.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.