Get 510d Pass-through Entity Declaration Of Estimated Income Tax

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 510D PASS-THROUGH ENTITY DECLARATION OF ESTIMATED INCOME TAX online

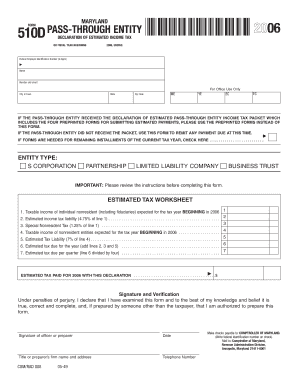

The 510D pass-through entity declaration of estimated income tax is an important form used by pass-through entities in Maryland to declare and remit estimated tax for nonresident members. This guide will provide you with clear, step-by-step instructions to help you complete the form accurately online.

Follow the steps to successfully fill out your declaration form.

- Click ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- Enter the tax year in the designated space at the top of the form. This should reflect the year your pass-through entity’s tax year begins.

- Input the Federal Employer Identification Number, which consists of nine digits. If you have not secured one, indicate 'APPLIED FOR' along with the application date.

- Type or print the name of your pass-through entity as well as the business address, including the number and street, city or town, state, and zip code.

- Select the type of entity from the provided options: S Corporation, Partnership, Limited Liability Company, or Business Trust.

- Complete the estimated tax worksheet, which includes the calculation of taxable income and estimated tax liability for both nonresident individuals and entities. Follow each line to fill in the respective amounts accurately.

- If applicable, check the box to request replacement forms for further installments of the current tax year.

- Sign and date the form. Make sure that the authorized officer provides their title or the firm name and address.

- Enter the total nonresident tax due in the space provided. Include a check or money order made payable to the Comptroller of Maryland for the total amount due, ensuring that your Federal Employer Identification Number is included.

- Once you have completed and reviewed the form for accuracy, you can save changes, download, print, or share the completed form as needed.

Ensure compliance by submitting your 510D form online today.

The Maryland pass-through entity tax is designed for entities that pass their income directly to their owners or investors. This allows the income to be taxed at the individual level rather than at the corporate level. The 510D PASS-THROUGH ENTITY DECLARATION OF ESTIMATED INCOME TAX facilitates this process by helping businesses estimate and report their tax obligations accurately, ensuring compliance and optimizing tax strategies. Consider using uslegalforms to navigate the complexities involved.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.