Loading

Get Form 502cr

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FORM 502CR online

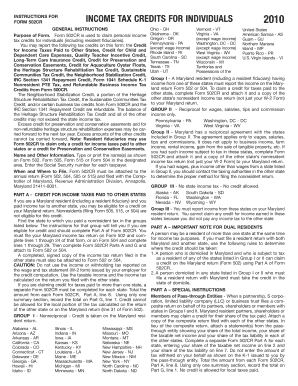

Filling out the FORM 502CR is essential for individuals claiming income tax credits in Maryland. This guide provides step-by-step instructions to help users complete the form correctly and efficiently, ensuring all necessary information is included.

Follow the steps to accurately complete the FORM 502CR online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your name and Social Security number in the designated areas as shown on your previous tax forms (Form 502, 504, 505, or 515). Ensure that names and numbers are entered accurately for verification.

- Review Part A of the form, which is for the credit for income taxes paid to other states. Identify any states where you have paid income tax and determine if you qualify for credits.

- If applicable, fill out the necessary details regarding taxes paid to other states as outlined in Group I and II. Complete parts A and G as instructed, attaching all required documentation from other state returns.

- Complete Part B if eligible for the credit for child and dependent care expenses by entering the necessary amounts based on your federal return.

- Fill out Part C if you are claiming the quality teacher incentive credit, ensuring all eligibility criteria and details for tuition costs are met.

- Proceed to Part G to summarize your total tax credits from Parts A through F, noting any non-refundable credits.

- Complete Part H if applicable, entering information for any refundable credits you may qualify for.

- Review all completed sections for accuracy. Save your changes, and if necessary, download or print the completed form to attach it to your annual tax return.

Complete your FORM 502CR online today to ensure you claim all eligible tax credits!

The Maryland pension exclusion allows certain retirees to exclude a portion of their pension income from state taxes. This provision applies to eligible individuals who meet specific income thresholds. Understanding these qualifications is crucial, as it can significantly impact your overall tax situation, and forms like FORM 502CR play a role in claiming this exclusion.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.