Loading

Get Form 510e

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FORM 510E online

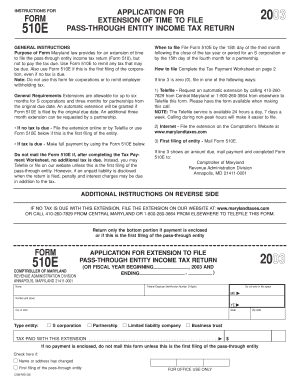

Filling out the FORM 510E is essential for those seeking an extension of time to file their pass-through entity income tax return. This guide provides clear, step-by-step instructions on completing the form online to ensure a smooth filing process.

Follow the steps to complete the FORM 510E online and ensure timely submission.

- Click the ‘Get Form’ button to obtain the form and open it in your preferred digital platform.

- In the designated fields, provide the name of the pass-through entity as well as any 'Trading As' names if applicable. Ensure that the name exactly matches the legal documents.

- Enter the Federal Employer Identification Number (FEIN). If a FEIN has not yet been secured, write 'APPLIED FOR' along with the application date.

- Indicate whether the name or address has changed by checking the appropriate box if applicable.

- Input the tax year or period by entering the starting and ending dates of the tax year as required.

- Complete the Tax Payment Worksheet by calculating the tentative tax owed, considering all estimated tax payments made previously.

- If there is any tax due, ensure to include the payment information, writing checks or money orders payable to the Comptroller of Maryland.

- Review all entered information for accuracy before proceeding.

- Once completed, save your changes, download a copy of the form for your records, and proceed to print or share as necessary.

Start completing your FORM 510E online today to ensure you meet all filing deadlines!

To fill an e-file, you need to select a suitable tax preparation software that supports Maryland tax forms. Begin by creating an account and inputting your personal and income information. Ensure that you include any relevant forms, like FORM 510E, if applicable. Double-check all entries before submitting electronically to ensure compliance with state regulations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.