Loading

Get Alternative Minimum Tax 2012 Calculation - Minnesota Department ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the alternative minimum tax 2012 calculation - Minnesota Department online

Completing the alternative minimum tax 2012 calculation form can seem complex, but with proper guidance, you can efficiently navigate the required steps. This guide aims to make the process straightforward and user-friendly.

Follow the steps to complete the form accurately.

- Click ‘Get Form’ button to obtain the alternative minimum tax 2012 calculation form and open it in the editor.

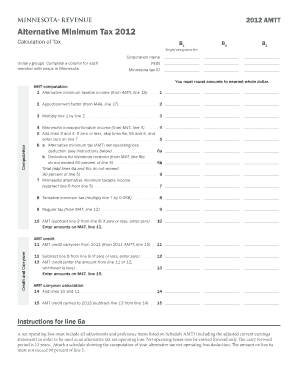

- Begin by entering your filing status in the designated field — select ‘single/designated filer’. If applicable, indicate whether you belong to a unitary group by completing a column for each member with nexus in Minnesota.

- Fill in the corporation name, Federal Employer Identification Number (FEIN), and the Minnesota tax ID in their respective fields.

- Calculate your alternative minimum taxable income by referring to your AMTI on line 19 and enter this value on line 1. Remember to round amounts to the nearest whole dollar.

- Determine the apportionment factor from M4A, line 17, and input this amount on line 2.

- Multiply the number entered on line 1 by the value on line 2, and record the result on line 3.

- Input the Minnesota nonapportionable income from M4T, line 4, into line 4.

- Add the figures from line 3 and line 4, and enter the total on line 5. If the result is zero or less, skip to line 7.

- If applicable, complete line 6a for the alternative minimum tax net-operating-loss deduction by following instructions below. Enter the deduction for dividends received from M4T, line 8b, not exceeding 90 percent of line 5 on line 6b.

- Total the deductions on lines 6a and 6b, ensuring it does not exceed 90 percent of line 5, and enter this on line 6.

- Calculate your Minnesota alternative minimum taxable income by subtracting line 6 from line 5 and enter this value on line 7.

- Multiply the amount on line 7 by 0.058 to determine your tentative minimum tax and enter this figure on line 8.

- Complete line 9 with the regular tax amount from M4T, line 12.

- Subtract line 9 from line 8 to calculate your AMT, entering it on line 10. If the result is zero or less, enter zero.

- For AMT credit calculations, complete lines 11 to 15 as instructed, ensuring all calculations are based on previous line entries.

- At the conclusion, review your entries, and then save changes, download, print, or share your completed form as necessary.

Complete your alternative minimum tax calculation form online today for a smoother filing experience.

Recouping alternative minimum tax can be done by applying credits in future tax years when your regular tax liability may be lower. You may carry forward unused AMT credits to offset regular tax in future periods. To navigate this process effectively, the Uslegalforms platform provides resources that can aid in understanding how to maximize your tax benefits.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.