Loading

Get Instructions For Form Ftb 3519 Payment For Automatic Extension For Individuals What S New Mandatory

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the instructions for form FTB 3519 payment for automatic extension for individuals online

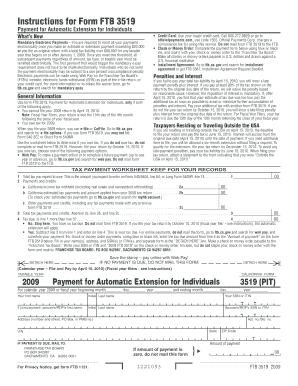

Filling out Form FTB 3519 for your automatic extension can be straightforward with clear guidance. This guide offers step-by-step instructions on how to complete the necessary sections and ensure compliance with electronic payment mandates.

Follow the steps to successfully complete your payment for automatic extension.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Enter your personal information accurately in the designated fields, including your first name, last name, and Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN). If applicable, include your spouse's or registered domestic partner's (RDP's) details.

- Indicate the taxable year you are filing for (2009) and complete the address section, including street number, city, state, apartment or suite number, and zip code.

- Calculate your total tax due by using the worksheet provided. Input the expected tax amount owed, along with payments and credits. If the total payments exceed the tax owed, discontinue here.

- If you owe tax, specify the amount of payment due in the space provided. Select your preferred method for payment: online via Web Pay, credit card, or by check or money order. Ensure that all payment information adheres to the guidelines.

- For check or money order payments, include your SSN or ITIN and ‘2009 FTB 3519’ on the payment. Detach the form as instructed and mail it to the specified Franchise Tax Board address.

- If you opt for online payment methods, skip mailing the form, and follow the directions pertaining to electronic payments.

Complete your documents online today to ensure a smooth filing process.

Related links form

If you're a calendar year filer and your tax year ends on December 31, the due date for filing your federal individual income tax return is generally April 15 of each year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.