Loading

Get Deduction For Dividends Received 2012 - Minnesota Department Of ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Deduction For Dividends Received 2012 - Minnesota Department Of ... online

This guide will help you navigate the process of filling out the Deduction For Dividends Received 2012 form online. By following the step-by-step instructions provided, you will be able to complete the form accurately and efficiently.

Follow the steps to complete the Deduction For Dividends Received form online.

- Press the ‘Get Form’ button to access the Deduction For Dividends Received 2012 form, allowing you to open and edit it online.

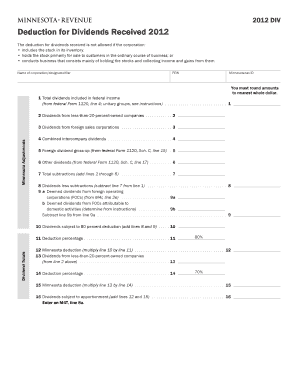

- Begin by entering the name of the corporation or designated filer in the appropriate field.

- Next, input the Federal Employer Identification Number (FEIN) and the Minnesota tax ID number.

- In line 1, record the total dividends included in federal income, referring to the corresponding line on federal Form 1120, line 4.

- For line 2, enter any dividends received from companies that you own less than 20 percent.

- Proceed to lines 3 to 6, where you will enter information for dividends from foreign sales corporations, combined intercompany dividends, foreign dividend gross-up, and other dividends respectively.

- On line 7, calculate total subtractions by adding the amounts entered on lines 2 through 6.

- Line 8 requires you to subtract the total subtractions on line 7 from the total dividends on line 1.

- Complete lines 9a and 9b with deemed dividends from foreign operating corporations, making sure to calculate the amounts accurately according to the instructions provided.

- Line 10 is where you will add lines 8 and 9 to find dividends subject to the 80 percent deduction.

- On line 11, indicate the deduction percentage, which is set at 80 percent.

- Multiply the amount on line 10 by the deduction percentage on line 11 to find the Minnesota deduction, which you will enter on line 12.

- Repeat similar steps for lines 13 to 15 for dividends from less-than-20-percent-owned companies and calculate any necessary deductions.

- On line 16, add the deductions from lines 12 and 15 to capture the total dividends subject to apportionment.

- Finally, review all inputted information for accuracy. After confirming that your entries are correct, you may save changes, download, print, or share the completed form.

Take action today and complete your Deduction For Dividends Received form online.

To show dividends on a tax return, summarize the total dividends received on your Form 1040, entering information from your Form 1099-DIV. Make sure you check any specific boxes related to the Deduction For Dividends Received 2012 - Minnesota Department Of if applicable. This will help ensure proper handling of your tax liability.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.