Loading

Get Ee Vat And/or Excise Duty Exemption Certificate 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the EE VAT And/or Excise Duty Exemption Certificate online

This guide provides a clear and comprehensive overview of how to complete the EE VAT And/or Excise Duty Exemption Certificate online. Whether you are an individual or part of an eligible body, following these steps will ensure your application is accurate and complete.

Follow the steps to accurately fill out the exemption certificate.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

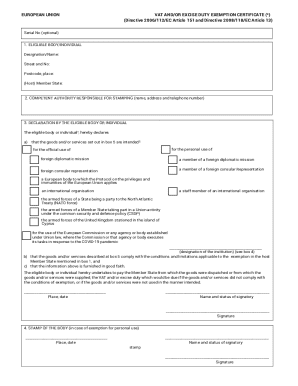

- In the first section ('Eligible body/individual'), enter your designation or name, street address and number, postcode and place, as well as the host Member State where you are located.

- For the 'Competent authority responsible for stamping' section, fill in the name, address, and telephone number of the relevant authority that will issue the stamp.

- In the 'Declaration by the eligible body or individual' section, select the applicable boxes to declare whether the goods and/or services are for personal use, official use of a foreign diplomatic mission, or other specified categories. Ensure that the institution's designation is clearly noted.

- Complete the information under the description of goods and/or services. This includes providing details about the supplier, the goods or services, their quantity, value excluding VAT, value per unit, total value, and the currency.

- In the 'Certification by the competent authorities of the host Member State' section, ensure that the description of goods or services meets the exemption criteria and affix the signature of the responsible authority.

- If applicable, fill out the permission section to dispense with the stamp under box 6, including the relevant authority's designation and signature, and ensure the document is dated appropriately.

- Once all sections are completed, review the form for accuracy. You can then save any changes, download, print, or share the form as required.

Complete your EE VAT And/or Excise Duty Exemption Certificate online today.

A VAT exception refers to specific circumstances under which VAT does not apply to certain goods or services. These exceptions can vary widely based on jurisdiction and the nature of the transaction. Understanding these exceptions is key for effectively using the EE VAT And/or Excise Duty Exemption Certificate, ensuring that you comply with regulations while maximizing your savings.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.