Loading

Get Ie Tr1 (ft) 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IE TR1 (FT) online

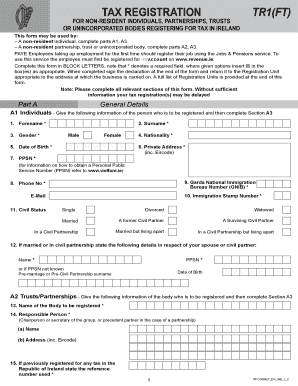

Filling out the IE TR1 (FT) online is an essential step for non-resident individuals, partnerships, trusts, or unincorporated bodies looking to register for tax in Ireland. This guide provides clear, step-by-step instructions to help you navigate each section of the form with confidence.

Follow the steps to complete the IE TR1 (FT) form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your general details. If you are an individual, complete Section A1. Fill in your forename, surname, gender, date of birth, nationality, private address (including Eircode), and contact details including phone number and email. If applicable, include your Garda National Immigration Bureau Number and PPSN.

- For non-resident partnerships, trusts, or unincorporated bodies, complete Section A2. Provide the name of the body, details of the responsible person, and state if previously registered for tax in Ireland.

- In Section A3, provide business or activity details. This includes trading name (if applicable), legal format, business address, type of business/activity, expected turnover, and tax adviser details if you have one.

- Continue to Part B for income tax registration. Indicate if you are registering for income tax and state your main source of income in Ireland.

- Proceed to Part C for VAT registration. Mark if you are registering for VAT, supply details for VAT-related activities, and include necessary transaction values along with bank account information for refunds.

- Complete Part D if registering as an employer for PAYE/PRSI by indicating your intention to hire employees. Include their residency status and the start date of their employment.

- Fill out any additional parts necessary, like Part E for Relevant Contracts Tax registration if applicable.

- Finally, review all entered information, sign the declaration at the end, and submit the form to the appropriate Registration Unit.

- After completion, you can save your changes, download, print, or share the form as required.

Start completing your IE TR1 (FT) form online today to ensure your registration for tax in Ireland is processed smoothly.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Key steps in filing your tax return Step 1: File on Revenue Online Service (ROS) You must be registered for ROS. ... Step 2: Use the pre-populated online Form 11 on ROS. ... Step 3: Make your self-assessment. ... Step 4: Statement of Net Liabilities. ... Step 5: Send your return to Revenue.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.