Loading

Get To Enroll In Residents And Fellows Flexible Spending

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the To Enroll In Residents And Fellows Flexible Spending online

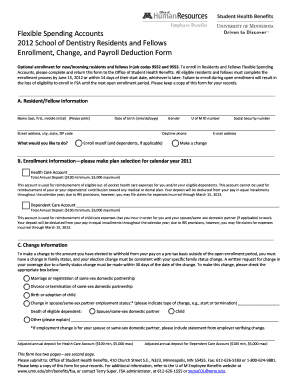

This guide provides a detailed overview for residents and fellows on how to successfully complete the enrollment form for Flexible Spending Accounts. By following these instructions, you can ensure that your enrollment is processed smoothly and efficiently.

Follow the steps to complete the enrollment form accurately.

- Press the ‘Get Form’ button to obtain the document and open it in your preferred editor.

- In section A, provide your personal information. This includes your name (last, first, middle initial), date of birth, gender, University of Minnesota ID number, and Social Security number. Ensure that all details are entered accurately to avoid processing delays.

- Move to section B, where you will select your Enrollment Information for the calendar year. Indicate your choice between a Health Care Account or a Dependent Care Account.

- In section C, proceed to detail any change information if applicable. If you need to adjust the amount withheld from your pay due to a family status change, select the appropriate option (e.g., marriage, divorce, birth of a child) and provide details as needed.

- In section D, sign the authorization statement, ensuring that you understand the implications of your enrollment and payment deductions. Note that electronic signatures are not accepted, so you must provide a handwritten signature along with the date signed.

- Once all sections are completed and reviewed, you can save your changes, download the document, and print it. Be sure to keep a copy for your records. Finally, submit the form to the Office of Student Health Benefits via mail or fax as indicated.

Complete your enrollment in the Flexible Spending Accounts online today!

Individuals often choose a Flexible Spending Account to save on taxes while covering their healthcare costs reasonably. By enrolling in a Residents and Fellows Flexible Spending plan, you can use pre-tax dollars for qualified medical expenses, which can lead to substantial savings. Many find this financial strategy beneficial as it allows them to budget effectively for medical expenses.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.