Loading

Get At Zs-ae Certificate Of Residence 2013-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AT ZS-AE Certificate Of Residence online

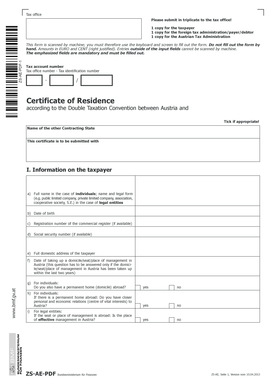

Filling out the AT ZS-AE Certificate Of Residence is an important process for individuals and entities seeking tax relief under the Double Taxation Convention between Austria and another country. This guide will provide step-by-step instructions to assist users in completing the form accurately and efficiently online.

Follow the steps to complete the AT ZS-AE Certificate Of Residence form online.

- Click the ‘Get Form’ button to access the document and open it in the designated online editor.

- Begin by filling out the taxpayer information in Section I. This includes the full name, date of birth, and if applicable, the registration number and social security number.

- Provide the full domestic address of the taxpayer accurately.

- If the taxpayer has established a domicile, seat, or place of management in Austria within the last two years, input the date in the specified field.

- For individuals, answer whether they have a permanent home abroad and whether they have closer relations to Austria.

- For legal entities, indicate whether the place of effective management is in Austria if the seat or place of management is abroad.

- In Section II, enter information about the foreign income. This includes the full name and address of the income debtor, the type of income, the effective or expected income amount, and the date or time period of the income.

- Confirm the accuracy of the information provided and include the taxpayer's signature.

- Once all sections are completed, users can save changes, download, print, or share the filled form as necessary.

Complete your AT ZS-AE Certificate Of Residence online today for efficient tax management.

The Austrian tax system for foreigners If you live in Austria and spend more than 180 days per year in the country, you are officially a tax resident. Austria also has double taxation agreements with several countries worldwide including Australia, Canada, China, and the United Kingdom.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.