Loading

Get Section Salary

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Section Salary online

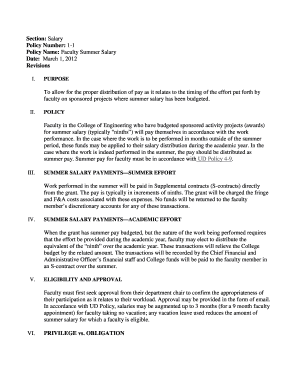

Filling out the Section Salary is an important process for faculty involved in funded projects that include summer salary. This guide provides clear instructions to assist you in completing the form correctly and effectively.

Follow the steps to complete the Section Salary form online.

- Click ‘Get Form’ button to access the Section Salary form and open it for editing.

- Review the information regarding your faculty role and eligibility for summer salary as specified in the policy.

- Fill in your personal information, including your name, department, and policy number.

- Indicate the funded project(s) you will be working on during the summer, in alignment with the summer salary budget.

- Specify the intended salary distribution, noting whether you will receive pay during the summer or if it will be distributed over the academic year.

- Obtain necessary approvals from your department chair as per policy requirements, which can be documented through email.

- Ensure that any obligations related to project responsibilities or graduate student support are confirmed.

- Once all information is filled out and confirmed, save changes to the document. You can also choose to download, print, or share the completed form.

Complete your Section Salary form online to ensure timely processing of your summer salary.

Related links form

If you made less than $5,000, you generally do not have to file a tax return, but there are exceptions based on your situation, such as self-employment income. It's essential to consider your total income and any elements related to Section Salary that may influence your filing. If you are unsure, it may be beneficial to consult a tax professional for clarity.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.