Loading

Get Irs 1120-l 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1120-L online

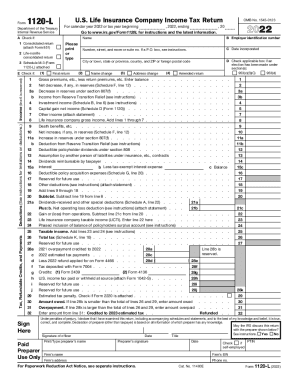

Filling out the IRS 1120-L form accurately is essential for life insurance companies to report their income, deductions, and tax liabilities. This guide provides a clear and supportive step-by-step approach to assist users in completing this form online.

Follow the steps to complete the IRS 1120-L form effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the employer identification number in section B, ensuring it is accurate to prevent processing delays.

- Fill in the company information, including the name, address, and date incorporated. Ensure that the information is current and correct.

- Specify if this is a consolidated return or if any elections have been made under the applicable sections. Check the appropriate boxes as necessary.

- Proceed to report income. Complete lines for gross premiums, investment income, and any other sources of income, totaling them to reflect the life insurance company’s gross income.

- Detail any deductions regarding death benefits, reserve increases or decreases, and other specific deductions as stated on the form. Be sure to consult relevant instructions for clarification.

- Calculate the taxable income, ensuring all additions and subtractions are captured correctly from the income and deductions reported in the previous steps.

- Complete the tax computation section to determine the total tax owed. Make sure to include credits and any prior year overpayments as applicable.

- Review all entered information thoroughly to ensure accuracy before finalizing the form.

- Save changes, download, print, or share the completed IRS 1120-L form as needed, making sure to keep a copy for your records.

Complete your IRS 1120-L form online today and stay compliant with tax regulations!

Form 1040 is used by U.S. taxpayers to file an annual income tax return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.