Loading

Get Ak 6000i 2021

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AK 6000i online

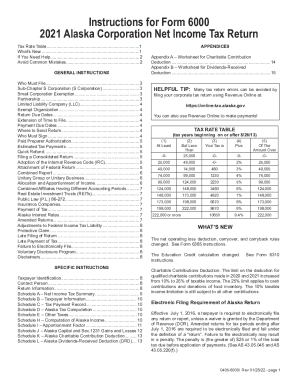

The AK 6000i, Alaska Corporation Net Income Tax Return, is a crucial document for corporations conducting business in Alaska. This guide provides comprehensive and user-friendly instructions on how to fill out the form online, ensuring accurate and timely submissions.

Follow the steps to complete your AK 6000i online accurately.

- Press the ‘Get Form’ button to access the AK 6000i form and open it in your preferred digital editor.

- Enter the taxpayer identification details, including the name and federal Employer Identification Number (EIN) in the designated fields.

- Provide the contact person's information. This should include the name, email address, and telephone number of an authorized individual who can respond to queries regarding the tax return.

- Complete the 'Return Information' section by selecting any applicable checkboxes. Be sure to check the appropriate box if it is a consolidated return or if claiming a small corporation exemption.

- Fill out Schedule A - Net Income Tax Summary to report the corporation's net income tax virtual details, attaching Form 6385 if applicable for net operating losses.

- Proceed to Schedule B where you will list all members of the Alaska consolidated group, ensuring that the information provided is accurate and complete.

- Document your tax payment record in Schedule C by entering dates and amounts of estimated tax payments made during the tax year.

- Utilize Schedule D to calculate the Alaska tax due based on the instructions provided, using the Tax Rate Table for reference.

- Complete Schedule E to report any additional taxes due, making sure no relevant information is overlooked.

- Fill out Schedule H to compute your Alaska income based on your federal taxable income, ensuring all values reconcile with the attached federal return.

- Finalize the form by reviewing all sections for completeness and accuracy before saving your changes. Once satisfied, you can download, print, or share the completed AK 6000i form as per your requirements.

Complete the AK 6000i online today to ensure compliance and avoid potential penalties.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

If you make $100,000 a year living in the region of Alaska, USA, you will be taxed $22,671. That means that your net pay will be $77,329 per year, or $6,444 per month.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.