Get Certificate Of Error

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Certificate Of Error online

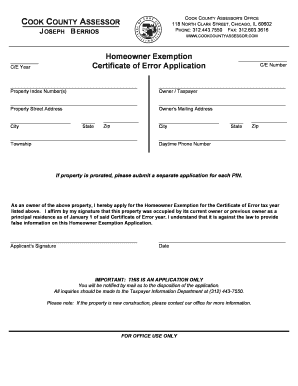

Completing the Certificate Of Error online is an essential process for those seeking to claim a Homeowner Exemption for their property. This guide will assist you in navigating each section of the form, ensuring a smooth and efficient application experience.

Follow the steps to successfully complete your application.

- Click ‘Get Form’ button to access the Certificate Of Error application. This will allow you to open the form in your online document editor.

- Fill in the C/E Year. Enter the specific tax year for which you are seeking the Certificate Of Error.

- Provide the Property Index Number(s). This number is essential for identifying your property in public records.

- Enter the Owner/Taxpayer's name. This should reflect the individual or entity that holds ownership of the property.

- Input the Property Street Address. Include the complete address of the property in question.

- Fill in the Owner's Mailing Address. This will be the address where you receive any correspondence regarding your application.

- Specify the City, State, and Zip code for the Owner's Mailing Address.

- Indicate the Township relevant to your property, as well as the City and State for the Certificate Of Error.

- Provide a daytime phone number where you can be reached for any inquiries regarding your application.

- If your property has multiple indexes, submit a separate application for each Property Index Number.

- As the owner of the property, you will need to affirm that it was occupied as your principal residence as of January 1 of the tax year stated above. This affirmation must be completed by your signature.

- Enter the date on which you complete the application.

- Review all information for accuracy before submitting the form. Once confirmed, you can save changes, download, print, or share the completed form as necessary.

Complete your Certificate Of Error application online today to ensure you receive your Homeowner Exemption.

A county assessor may visit your home for various reasons, such as conducting a routine property assessment or verifying information about your property. They may come to gather data to ensure that your property assessments are accurate. If you believe there has been an error, you can use the Certificate of Error to address discrepancies. Being proactive in understanding your assessment can result in fairer property taxes.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.