Loading

Get E 595e

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the E 595e online

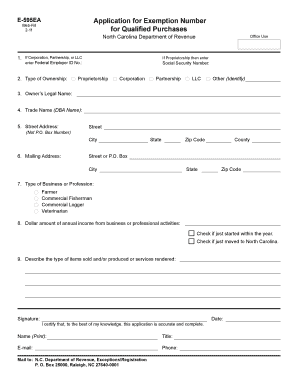

The E 595e form serves as an application for an exemption number for qualified purchases. This guide will provide you with a clear and step-by-step approach to filling out the form online, ensuring that you have all the necessary information to complete the application accurately.

Follow the steps to successfully complete the E 595e form online.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the Federal Employer ID Number (FEIN) if applicable. If you are a sole proprietorship, provide your Social Security Number.

- Select the type of ownership from the provided options: Proprietorship, Corporation, Partnership, LLC, or Other. Identify if you choose 'Other'.

- Input the owner's legal name in the designated field.

- Enter the trade name (Doing Business As name) for your business.

- Fill in your business's street address. Ensure that you do not use a P.O. Box number for this section.

- Provide your mailing address to receive correspondence regarding your exemption number. You may use a street address or P.O. Box.

- Indicate the type of business or profession you are engaged in from the options provided.

- Estimate your annual income from your business activities. Check the corresponding boxes if you have just started within the current year or have recently moved to North Carolina.

- Describe the items sold, produced, or services rendered by your business.

- Sign and date your application, print your name, title, email, and phone number for contact purposes.

- Once completed, save your changes, download the form, print it, or share it as needed.

Complete the E 595e form online to streamline your exemption number application process.

You can get your exemption certificate by completing the required forms, such as the E 595e, and submitting it to the appropriate state authority. Make sure you include all necessary information to avoid delays. After processing, the authority will issue your exemption certificate, allowing you to make qualifying purchases.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.