Loading

Get Ameritrade Ira Distribution/withholding Form 2006-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ameritrade IRA Distribution/Withholding Form online

Filling out the Ameritrade IRA Distribution/Withholding Form online can seem daunting, but this guide will simplify the process for you. Follow the steps below to ensure a smooth completion of your form, tailored to your financial needs.

Follow the steps to accurately fill out the Ameritrade IRA Distribution/Withholding Form.

- Press the ‘Get Form’ button to access the Ameritrade IRA Distribution/Withholding Form and open it in an online editor.

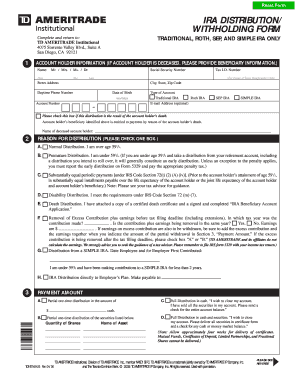

- Fill in the account holder information section, which includes your name, Social Security Number, date of birth, and contact information. Ensure that these details are accurate to avoid any processing issues.

- Select the type of IRA account you have — Traditional, Roth, SEP, or SIMPLE IRA — by checking the appropriate box.

- If applicable, indicate if the distribution results from the account holder’s death by checking the designated box and providing the deceased's name.

- In the reason for distribution section, carefully check one option that best describes why you are requesting a distribution, such as normal distribution, premature distribution, or disability distribution.

- Specify the amount you wish to withdraw in the payment amount section. Choose from the options provided: partial one-time distribution in cash, partial distribution of securities, or a full distribution of cash or securities.

- If you wish to receive periodic cash payments, complete the periodic payment section, indicating the amount and frequency of payments.

- Select your tax withholding election by checking either to withhold federal or state taxes and indicating an amount or percentage if you choose above the standard rate.

- Choose your preferred method of payment: to your address of record, to another TD Ameritrade account, or to an alternate address.

- Complete the account holder authorization section with your signature and date, confirming the accuracy of the information provided.

- Review all sections for accuracy before proceeding. Once everything is complete, you can save changes, download, print, or share the form as needed.

Start completing your Ameritrade IRA Distribution/Withholding Form online today!

The IRS form used to report IRA distributions is Form 1099-R. This form is provided by your IRA custodian to report distributions made throughout the year. You will use the information on Form 1099-R to complete your tax return, detailing both the total distribution and the taxable amount. For further assistance, refer to the Ameritrade IRA Distribution/Withholding Form as you prepare to file your taxes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.