Loading

Get Ic1 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ic1 Form online

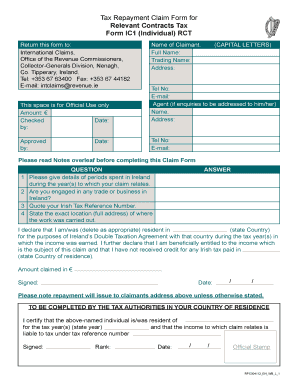

The Ic1 Form is a crucial document for individuals seeking tax repayment claims related to relevant contracts tax. This guide provides clear and supportive instructions on how to fill out the form online, ensuring that all users, regardless of their legal expertise, can complete the process with confidence.

Follow the steps to complete the Ic1 Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In the first section, provide your personal details, including your full name, trading name, address (make sure to use capital letters), telephone number, and email address.

- If applicable, fill out the agent's information by providing their name, address, telephone number, and email for any inquiries.

- Carefully read the notes provided with the form to ensure you understand any instructions or additional requirements.

- In the question section, provide details about the periods you spent in Ireland during the relevant tax years, including whether you were engaged in any trade or business in Ireland.

- Enter your Irish Tax Reference Number and the exact location of where the work was carried out.

- Declare your country of residence for the purposes of Ireland’s Double Taxation Agreement, confirming you have not claimed credit for any Irish tax paid in that country.

- Indicate the amount you are claiming in euros. Sign and date the form to validate your claim.

- Ensure all supporting documents, such as tax deduction certificates or questionnaires, are attached as required.

- Finally, save your changes, and download, print, or share the completed form as needed.

Complete your tax repayment claim form online today to ensure a smooth and efficient process.

Related links form

To obtain a form ID for your Ic1 Form, simply log into the platform you are using. Typically, there will be a dedicated section for forms where you can create one or access existing forms. Each form you create will automatically generate a unique ID, making it convenient for tracking your submissions and maintaining a clear record.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.