Loading

Get Ny Dtf It-242 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY DTF IT-242 online

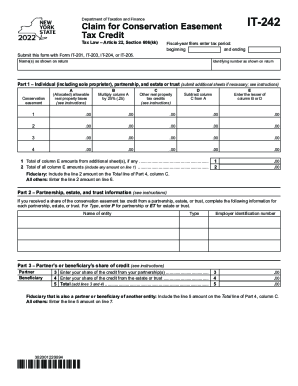

Filling out the NY DTF IT-242 form for claiming the conservation easement tax credit can be straightforward if you follow the right steps. This guide provides you with detailed instructions to help you successfully complete each section of the form online.

Follow the steps to complete your NY DTF IT-242 form successfully.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your name(s) as shown on the return and the identifying number as it appears on the return.

- In Part 1, fill out the allowable columns for other real property conservation easement tax credits based on the instructions provided. Ensure every entry is clear and consistent.

- Continue by multiplying the allowable conservation real property taxes by 25% in the appropriate column. Subtract column C from column A to arrive at the necessary totals.

- For Partnerships, estates, or trusts that may affect your tax credit, fill out the relevant information in Part 2, ensuring to note the type and employer identification number.

- In Part 3, enter your share of the credit from partnerships and estates or trusts if applicable. Calculate the total and move to the next section.

- For fiduciaries, complete Part 4 by recording the beneficiary's name and their corresponding share of conservation easement credit accurately.

- Proceed to Part 5 where you'll compute your conservation easement tax credit. Input totals based on previous sections and adhere strictly to the provided instructions regarding limits.

- Finally, complete Part 6 with the conservation easement identifying information, making sure to include the correct dates of conveyance and other details as necessary.

- After completing all sections, save your changes, and you can opt to download, print, or share the filled-out form as needed.

Begin filling out your NY DTF IT-242 online today for a smoother tax credit application process.

New York City Pass-through Entity Tax (NYC PTET) The PTET is an optional tax that partnerships or New York S corporations may annually elect to pay on certain income for tax years beginning on or after January 1, 2021.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.