Loading

Get Md Form 502cr 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MD Form 502CR online

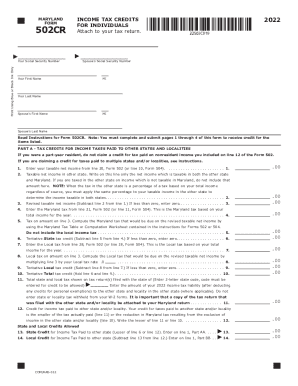

Filling out the MD Form 502CR is an essential step for Maryland residents seeking to claim personal income tax credits. This guide provides clear, step-by-step instructions to help users complete the form accurately and efficiently online.

Follow the steps to fill out the MD Form 502CR online.

- Click the ‘Get Form’ button to access the MD Form 502CR and open it in the editor.

- Begin by entering your Social Security number and the Social Security number of your spouse if applicable.

- Fill in your first and last name, as well as your spouse's first and last name, if you are filing jointly.

- Read the instructions carefully before proceeding to Part A, which details tax credits for income taxes paid to other states and localities.

- In Part A, provide your taxable net income and the taxable net income from the other state. Ensure to include only the amounts taxable in both states.

- Calculate the revised taxable net income by subtracting the taxable net income in the other state from your Maryland taxable net income.

- Complete lines related to the state tax as guided, computing local tax where applicable. Remember to enter the local tax amount based on revised taxable net income.

- Continue filling out the remaining parts of the form, such as Part B which addresses credits for child and dependent care expenses.

- After completing all parts of the form, review all entries for accuracy and ensure all required documentation is attached based on the instructions.

- Finally, save your changes, download the completed form, and proceed to print or share it as needed.

Start filling out the MD Form 502CR online today to ensure you claim the credits you deserve.

Related links form

Generally, you are required to file a Maryland income tax return if: You are or were a Maryland resident; You are required to file a federal income tax return; and. Your Maryland gross income equals or exceeds the level listed below for your filing status.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.