Loading

Get Irs 8879-pe 2024-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8879-PE online

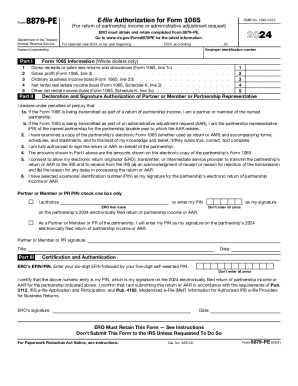

Filling out the IRS 8879-PE form online is essential for partnerships wishing to authorize e-filing of their tax returns. This guide provides comprehensive instructions on how to complete each section of the form to ensure accurate submission.

Follow the steps to successfully complete the IRS 8879-PE form online.

- Click the ‘Get Form’ button to access the IRS 8879-PE form. This will open the form in your browser for editing.

- In Part I, enter the gross receipts or sales, gross profit, ordinary business income or loss, net rental real estate income or loss, and other net rental income or loss. Ensure that all amounts are reported in whole dollars only as specified.

- In Part II, fill in the employer identification number and the name of the partnership. This section is crucial for accurately identifying your partnership.

- Read through the declaration and signature authorization section carefully. Ensure you check the correct box to indicate your role (partner, member, or partnership representative) and provide your personal identification number (PIN) as your electronic signature.

- Complete Part III by entering your ERO’s EFIN followed by your five-digit self-selected PIN. Enter your signature and the date of submission.

- Once all sections are completed, review the form for accuracy. Save your changes, and ensure that you take necessary actions to keep a copy of the completed form for your records or share it as required.

Start filling out your IRS 8879-PE form online today to ensure timely submission of your partnership’s tax return.

0:52 7:12 As a as I said the purpose of the form is to uh. Allow a tax practitioner to use a pin method to toMoreAs a as I said the purpose of the form is to uh. Allow a tax practitioner to use a pin method to to generate the personal ID number for you to sign your tax return. So part of this allows the tax

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.