Loading

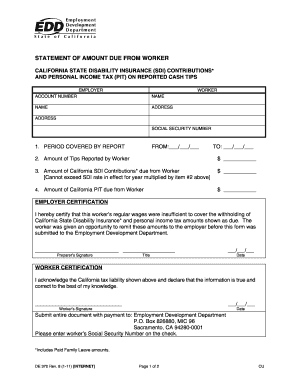

Get Statement Of Amount Due From Worker California State Disability Insurance (sdi) Contributions* And

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the STATEMENT OF AMOUNT DUE FROM WORKER CALIFORNIA STATE DISABILITY INSURANCE (SDI) CONTRIBUTIONS* AND online

Filling out the Statement of Amount Due from Worker California State Disability Insurance contributions and Personal Income Tax on reported cash tips is crucial for both employers and workers. This guide provides clear instructions to assist you in accurately completing this document online.

Follow the steps to successfully fill out the form.

- Click ‘Get Form’ button to access the form and open it in your editing tool.

- Enter the period covered by the report. Fill in the 'From' date and 'To' date in the specified format (MM/DD/YYYY) for the reporting period.

- Input the total amount of tips reported by the worker in the appropriate field, using only numbers.

- Calculate the amount of California State Disability Insurance contributions due from the worker. This should not exceed the SDI rate for the year multiplied by the amount of tips reported.

- Fill in the amount of California Personal Income Tax due from the worker in the designated section.

- The employer must provide a certification by signing and dating the form. Ensure all details regarding the employer's certification and position are correctly filled out.

- The worker must acknowledge their tax liability by signing and dating the appropriate section of the form, confirming the accuracy of the reported information.

- Once all sections have been completed, review the document for accuracy. Save changes and download or print the form for submission.

- Submit the entire document along with any required payment to the Employment Development Department at the specified mailing address.

Complete your forms online today to ensure compliance and timely submission.

Employers do not pay for State Disability Insurance (SDI) benefits. The SDI program is funded entirely through mandatory employee payroll contributions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.