Loading

Get 2024 M1pr, Property Tax Refund Return

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2024 M1PR, Property Tax Refund Return online

This guide provides step-by-step instructions on completing the 2024 M1PR, Property Tax Refund Return online. Users will find clear guidance on each section and field to ensure a smooth and accurate filing process.

Follow the steps to complete your Property Tax Refund Return accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

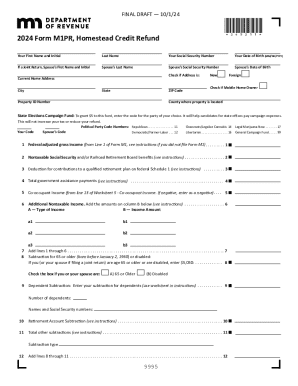

- Begin by entering your personal information, including your first name, initial, last name, Social Security number, and date of birth in the designated fields. If you are filing jointly, include your partner's information as well.

- Indicate your current home address, city, state, property ID number, and ZIP code. Make sure to check the appropriate box if you are a mobile home owner.

- Provide your county of residence where the property is located.

- Decide whether to contribute to the State Elections Campaign Fund by entering a political party code if desired. This contribution will not affect your tax or refund amount.

- Fill out your federal adjusted gross income as instructed from Form M1. Include the amounts for nontaxable Social Security and/or Railroad Retirement Board benefits as needed.

- Enter any deductions such as contributions to a qualified retirement plan, total government assistance payments, and co-occupant income. Ensure all negative figures are entered accordingly.

- Calculate and input the total other subtractions and carry these figures through to the subsequent lines.

- Complete the section for property tax amounts, inputting information from the Statement of Property Taxes Payable for 2025.

- Check all calculations carefully to ensure accuracy, including any contributions to funds and direct deposit information.

- Once finished, save your changes, and choose to download, print, or share the completed form for submission.

Complete your 2024 M1PR, Property Tax Refund Return online today for a hassle-free filing experience.

You should get your refund within 60 days after you file or after August 15 for renters and September 30 for homeowners. Whichever is later. You can get your refund up to 30 days earlier if you: file electronically and do the following things: File electronically.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.