Get John Controls 150.68-o1.en.ce 2011-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the John Controls 150.68-O1.EN.CE online

Filling out the John Controls 150.68-O1.EN.CE form online can be a straightforward process when you understand the components and necessary steps involved. This guide will provide detailed, user-friendly instructions to help you complete the form effectively.

Follow the steps to fill out the form correctly.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Review the first section titled 'General' to understand the purpose of the form and the equipment it pertains to. This section includes key information on system operations and control mechanisms.

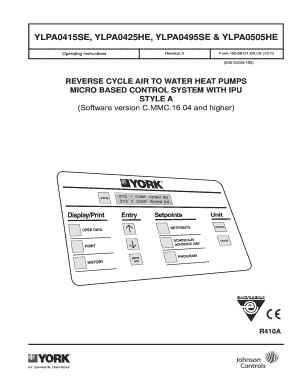

- Complete the 'Control Panel' section by filling in the details relevant to the control system in your unit. Be sure to include settings for the unit ON/OFF switch and customer controls.

- Fill out the 'Operation' section by entering data related to mode control and capacity control specifics. Ensure that you refer to the ranges and limits advised in the guidelines.

- Input required data for 'Control Panel Keys,' ensuring that you include setpoint keys and user commands as per your operational needs.

- For the 'Diagnostics' and 'Commissioning' sections, enter any relevant fault conditions or commissioning settings necessary for your system's operation.

- In the 'Inputs/Outputs' section, indicate any digital and analogue inputs that are applicable to your setup.

- Review the 'Optional Printer Installation' section if you plan to enable this feature. Fill in the necessary details for connecting your printer.

- Finalize by reviewing all sections for accuracy, and upon confirmation, save any changes made. You may then choose to download, print, or share the completed form as required.

Begin filling out your John Controls 150.68-O1.EN.CE form online today for effective system management.

Employers are responsible for several key payroll taxes, including federal income tax withholding, Social Security taxes, Medicare taxes, and state unemployment insurance. Using reliable software such as John Controls 150.68-O1.EN.CE can help employers accurately calculate and report these taxes. This ensures both compliance with the law and ease in managing payroll. Staying on top of these responsibilities is crucial for avoiding fines and maintaining a good standing with tax authorities.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.