Loading

Get Hi Form Ta-1 2016-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the HI Form TA-1 online

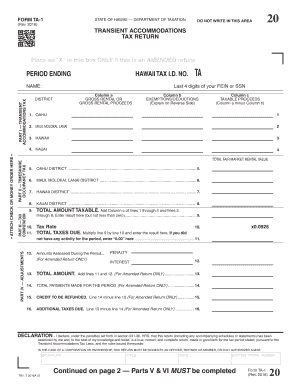

Filling out the HI Form TA-1 online is an important step for individuals managing transient accommodations in Hawaii. This guide provides comprehensive instructions to help you accurately complete the form with ease.

Follow the steps to fill out the HI Form TA-1 online effectively.

- Press the ‘Get Form’ button to retrieve the HI Form TA-1, opening it in your online editor for completion.

- Enter the period ending date at the top of the form. This is the date for which you are reporting transient accommodations tax.

- Input your Hawaii Tax I.D. number and your name in the designated fields. Ensure accuracy to avoid processing delays.

- In Part I – Transient Accommodations Tax, fill in the gross rental or gross rental proceeds for each district, marking any exemptions or deductions as needed.

- Proceed to Part II – Timeshare Occupancy Tax and fill in any applicable details regarding timeshare rentals, if relevant.

- In Part III – Tax Computation, calculate the taxable proceeds by subtracting any exemptions from your gross rental amounts. Total these at the end of the section.

- In Part IV – Adjustments, enter details for any penalties or interest incurred, applicable only if this is an amended return.

- Complete the Declaration section by signing the form digitally, including your title, date, and daytime phone number for contact purposes.

- If applicable, continue to Part V and VI for further details regarding total amounts due and any exemptions or deductions claimed.

- After completing the form, save your changes, and you may choose to download, print, or share the completed HI Form TA-1 as needed.

Complete your HI Form TA-1 online today for timely and accurate submission.

Effective December 14, 2021, the City and County of Honolulu imposed an Oahu County Transient Accommodations Tax (OTAT) at the rate of 3% on gross rental proceeds and/or fair market rental value attributable to Oahu if the taxpayer lets the transient accommodation for less than 180 days.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.