Loading

Get Vat Reclaim Form - Uk

We are not affiliated with any brand or entity on this form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VAT Reclaim Form - UK online

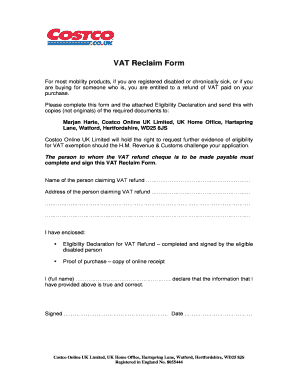

Filling out the VAT Reclaim Form is a straightforward process for individuals registered as disabled or chronically sick who wish to reclaim VAT on their purchases. This guide will provide you with clear instructions to complete the form accurately and efficiently, ensuring you have the necessary information for a successful reclaim.

Follow the steps to fill out your VAT Reclaim Form online:

- Press the ‘Get Form’ button to access the VAT Reclaim Form and open it in your preferred editor.

- Begin by entering the name of the person claiming the VAT refund in the designated field.

- Next, provide the address of the individual claiming the VAT refund, ensuring all relevant address lines are filled out.

- Attach the completed and signed Eligibility Declaration, confirming that the claimant meets the necessary criteria for VAT exemption.

- Include a copy of the proof of purchase, such as an online receipt, in your submission.

- Sign the form by writing the full name of the claimant, followed by their signature and the date.

- Review all entered information for accuracy and completeness before final submission.

- After reviewing, you can save changes, download the completed form, or print it for your records.

Start submitting your VAT Reclaim Form online today.

VAT refunds for overseas visitors in British shops have now been removed. Overseas visitors can still buy items VAT-free in store and have them sent direct to overseas addresses.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.