Loading

Get Hk Irbr61 2017-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the HK IRBR61 online

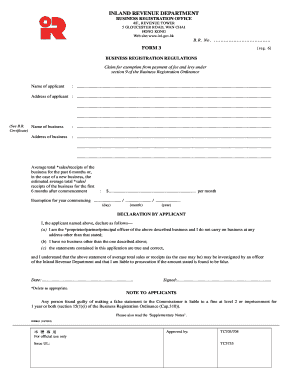

This guide provides a comprehensive overview of how to successfully fill out the HK IRBR61 form for business registration exemption. By following these clear steps, users can efficiently navigate the application process, ensuring all necessary information is accurately submitted.

Follow the steps to complete your HK IRBR61 application.

- Press the ‘Get Form’ button to access the HK IRBR61 application form. Ensure the document opens properly in your digital workspace.

- Begin by entering your name in the designated field for 'Name of applicant'. Ensure there are no typographical errors for accurate identification.

- Fill in your complete address in the 'Address of applicant' section. Include all relevant details to ensure proper location verification.

- Next, provide the 'Name of business' as registered or intended and follow with the 'Address of business' where operations will be conducted.

- In the 'Average total sales/receipts of the business for the past 6 months' section, enter the calculated monthly average turnover based on your actual income (for existing businesses) or estimated turnover (for new businesses). Refer to the explanatory notes if needed.

- Indicate the exemption year by specifying the date in the provided fields—day, month, and year for when the exemption commences.

- Complete the declaration by confirming you are the owner or principal officer of the business. Check the appropriate box to affirm that you do not operate another business from a different location.

- Sign and date the application at the bottom. Ensure that all provided information is truthful to avoid any legal issues.

- Upon final review of your completed form, you can save the changes, download, print, or share the application as needed.

Take the next step in your business registration process by filling out the HK IRBR61 form online today.

Related links form

What is the business tax number in Hong Kong? The Business Registration Number (BRN) in Hong Kong is a unique 8-digit number issued by the Inland Revenue Department (IRD) and serves as the tax identification number (TIN) for businesses. It is essential for legal business operations and tax payments in Hong Kong.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.