Loading

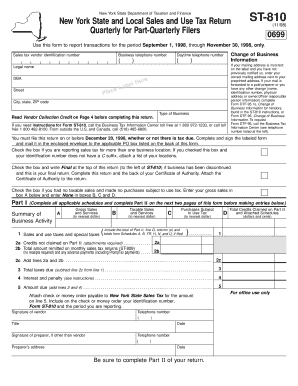

Get Form St-810: November 1998 , New York State And Local Sales And ... - Tax Ny

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Form ST-810: November 1998, New York State and Local Sales and Use Tax online

Filling out Form ST-810 is essential for reporting sales and use tax in New York State. This guide will provide a clear and structured approach on how to accurately complete the form online, ensuring compliance with state tax regulations.

Follow the steps to successfully complete the Form ST-810 online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Begin by entering your sales tax vendor identification number at the top of the form. This number is crucial for identification.

- Input your business telephone number and daytime telephone number in the designated fields.

- If your mailing address is incorrect, please enter the correct address next to the preprinted one.

Complete your Form ST-810 online today to ensure your sales tax is reported accurately and on time.

The state as a whole has a progressive income tax that ranges from 4. % to 10.9%, depending on an employee's income level. There is also a supplemental withholding rate of 11.70% for bonuses and commissions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.